Estate planning is about more than passing down property. It is also about preserving the value of what you leave behind. In Maryland, estate taxes can diminish the value of an estate significantly if you do not take proactive steps to protect it. Receiving support from an estate planning attorney in Annapolis, MD is the first step to protecting your estate.

From an Estate Planning Attorney in Annapolis, MD: Protecting Your Estate From High Taxation

Unlike most states, Maryland imposes both an estate tax and an inheritance tax. The Maryland estate tax applies to estates exceeding a certain exemption amount, which is subject to change under state law, and amounts above this exemption may be taxed at rates as high as 16 percent.

Looking to the future, this tax would apply to the value of your estate at the time of your death. This includes any real estate, all bank accounts, retirement assets, life insurance proceeds, and your personal property. Without careful planning, your estate could face a huge tax burden that greatly reduces what your heirs ultimately receive.

Evaluating the Role of Lifetime Gifts

You may be able to reduce your taxable estate by giving assets to your beneficiaries during your lifetime. Maryland law permits certain lifetime gifts that can remove assets from your estate and lower your potential tax exposure.

However, gift planning must be done carefully to avoid triggering the federal gift tax or undermining other estate goals. We can help you evaluate your options, including the annual gift tax exclusion and other lawful strategies that fit your broader plan.

Using Trusts to Limit Tax Exposure

Trusts are one of the most effective tools we use to help clients protect their estates. A properly structured trust can move assets out of your taxable estate while allowing you to retain some control over their use. We work with you to select and draft trust instruments that serve your interests while maximizing all the possible tax advantages under Maryland law.

Coordinating With Federal Tax Rules

Maryland estate tax planning must align with federal tax rules, including the federal estate tax exemption and gift tax laws. In some cases, the federal and state exemptions set different requirements, which means you may need expert legal support to avoid unintended tax consequences or a situation where protecting yourself in one direction exposes you in another. We can help you structure your estate plan in a way that addresses both state and federal tax issues, ensuring that your strategies are cohesive and legally sound.

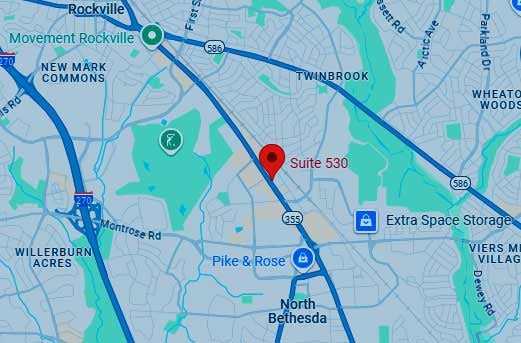

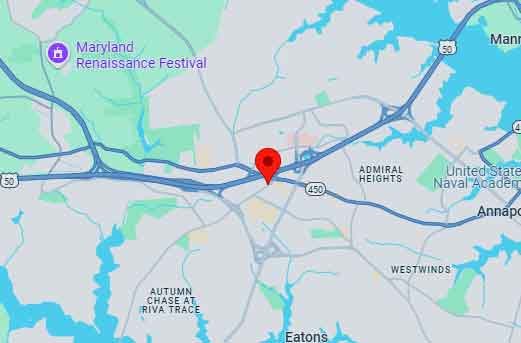

We know that protecting your estate from high taxation requires more than a one-size-fits-all solution, and your assets, family dynamics, and long-term goals deserve personalized attention. We will help you understand your options, implement strategies that comply with Maryland law as well as federal regulation, and secure the most favorable tax outcome possible. Schedule a consultation with us today at Elville & Associates at one of our locations in Annapolis, Columbia, and Rockville, MD, to begin building a plan that protects what matters to you.