Estate planning in Maryland allows you to determine how your assets are handled after your death, and one of the most effective strategies for protecting your estate is to first identify which assets pass outside of probate. Knowing what qualifies as exempt can help you streamline your plan and minimize unnecessary legal delays. Understanding this process with the support of an estate planning lawyer in Rockville, MD, is the first step to planning your financial future.

From an Estate Planning Lawyer in Rockville, MD: Assets That Are Not Subject to Probate

Transferring Jointly Owned Property

Assets held in joint tenancy with right of survivorship do not go through probate when one owner passes away. Instead, ownership automatically transfers to the surviving joint owner. This applies to both real estate and financial accounts.

For example, if you and your spouse own a home together as joint tenants, your share will transfer directly to your spouse without the need for probate. Maryland law supports this form of ownership as long as it is clearly stated in the title or account registration. We review your records to confirm that joint ownership is documented properly.

Distributing Payable-on-Death and Transfer-on-Death Accounts

Bank accounts, investment accounts, and retirement funds often allow you to name a beneficiary through a payable-on-death or transfer-on-death designation. These designations override the terms of your will and allow the account to transfer directly to the named individual.

This avoids probate and provides faster access to funds. To ensure these designations are valid, you must complete the correct forms with the financial institution and keep them updated if your circumstances change.

Passing Life Insurance Proceeds Outside of Probate

Life insurance policies are paid directly to the named beneficiaries listed on the policy. These proceeds are not subject to probate unless you name your estate as the beneficiary or fail to designate someone. If no beneficiary is named, the proceeds may become part of the probate estate, which can delay distribution. We help you confirm that your designations are in place and reflect your current wishes, especially in cases involving divorce, remarriage, or changes in family structure.

Using Revocable Living Trusts

A revocable living trust is a common method of transferring assets outside of probate. When you place property into a trust during your lifetime, that property is no longer considered part of your probate estate. The trustee you name can distribute the trust assets according to your instructions without court involvement. In Maryland, trusts must be funded correctly to function as intended. We prepare and review all trust documentation and ensure your assets are titled in the name of the trust to avoid confusion later.

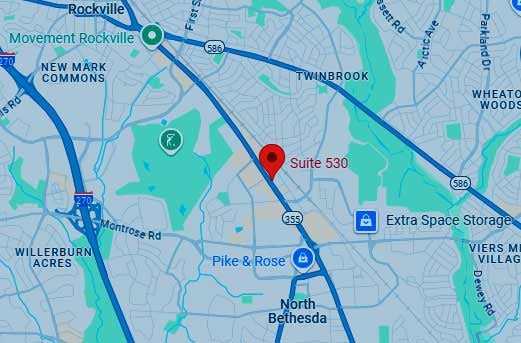

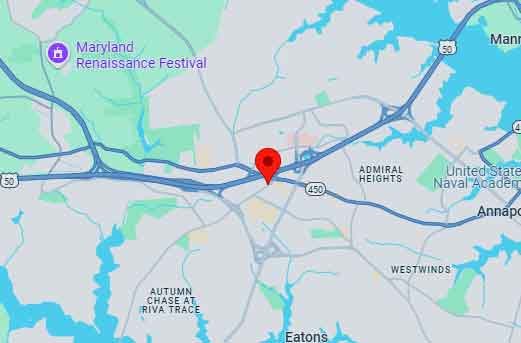

Exempting assets from probate helps your estate pass to beneficiaries with fewer delays and expenses. By using joint ownership, proper beneficiary designations, and revocable trusts, you reduce the burden on your estate and ensure your intentions are carried out efficiently. Schedule a consultation with us today at Elville & Associates in Rockville, Columbia, and Annapolis, MD, to work out a well-structured plan that gives you financial confidence and security.