Probate can be a time-consuming process, but there are ways to legally avoid it. In Rockville, MD, one solution is to hire an estate attorney to set up a living trust. This can make it easier to distribute assets and prevent the delays that are common with probate.

A living trust is a way of arranging assets that can be put in place before you die. There are two different types of living trusts: revocable and irrevocable. The former allows you to retain control during your lifetime and can be canceled. An irrevocable living trust cannot be canceled, and all control of the assets is handed to the trust.

Many individuals prefer the flexibility of a revocable living trust as it’s much simpler to manage. Although it’s possible to add to an irrevocable trust, the options are more limited and some transactions may require court approval. A revocable living trust allows the arrangements to be altered by a lawyer in response to changing living circumstances without any difficulty.

What Are the Benefits of a Living Trust?

The main benefit of a living trust is that it removes the named assets from the probate process. With a revocable living trust, it’s possible to retain full control during your lifetime while also appointing trustees to manage the assets after your death. It also has the potential to minimize estate taxes by strategically distributing assets to take full advantage of exemptions.

If you become incapacitated, the named trustees can use the trust to manage your affairs without needing to go to court. This is an additional benefit that provides peace of mind.

How Does a Living Trust Differ from a Will?

A will can also be used to distribute assets after death, but it is not automatically exempt from probate. This means there may be delays in distributing the estate. It is not possible to use a will to manage assets prior to death, even in the event of incapacity.

This doesn’t mean that a will has no value. Many individuals set up a “pour-over will” which works in tandem with the trust. Although the assets aren’t exempt from probate, they can be added to the living trust for easy management and distribution. This can be helpful to scoop up any assets that were inadvertently missed from the trust.

Seek Advice From an Experienced Estate Attorney

The legalities around using a living trust and will for maximum benefit can be complex, so it’s essential to seek professional advice. A skilled lawyer can help you structure your finances in a way that avoids probate and makes use of all available allowances. It’s advisable to review the arrangements with a lawyer regularly to ensure any changes are incorporated into the arrangements.

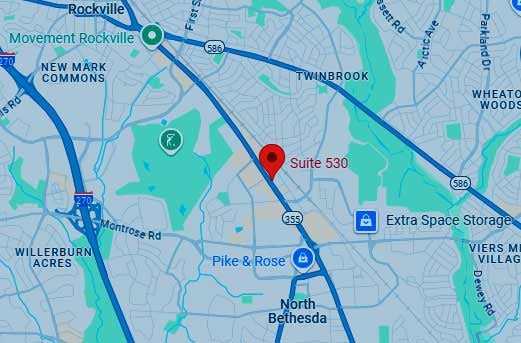

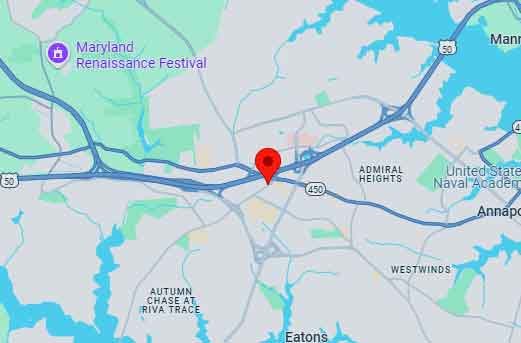

We deliver customized estate planning and are proud to serve clients in Central Maryland, the Eastern Shore, and the Washington Metro area. Contact Elville & Associates in Columbia, MD for professional advice you can trust. We also have offices in Rockville, MD and Annapolis, MD for convenient appointments.