After someone’s death, their property enters probate before it is distributed. The process of probate costs time and money, so it is wise to find legal ways to transfer property without probate. An estate lawyer in Columbia, MD, gives their advice.

How Can I Transfer Property Without Probate Under Maryland Law? Advice from an Estate Lawyer in Columbia, MD

What Is Probate?

Probate is the legal process that an individual’s finances and property enters upon their deaths. During the process, the individual’s will is validated, and the belongings are accounted for. Probate can be a lengthy process and involves required legal fees, which will reduce the value of the estate.

Set Up Joint Ownership

One of the most straightforward ways to avoid probate is to set up joint ownership. In Maryland, there are several forms of joint ownership, such as joint tenancy. If a joint tenancy is set up, it should clearly establish the right of both owners to inhabit the property upon the death of the other, i.e., the right of survivorship and tenancy by the entirety. If a joint ownership is set up properly before an individual’s death, the property passes directly to the other owner without going through probate.

Use Beneficiary Designations

In Maryland, real estate can also be transferred via a transfer-on-death deed. This type of deed allows the owner of a property to name a beneficiary who will receive the property upon the owner’s death. During the owner’s lifetime, they retain complete control of the property. When they die, the property transfers immediately to the beneficiary, bypassing probate. A transfer-on-death deed must be executed and recorded at the appropriate county’s land records office.

Establish a Revocable Living Trust

Irrevocable living trust is one of the most effective and versatile means of transferring property and avoiding probate. An individual can transfer the ownership of their assets into a living trust, which they retain complete control over during their lifetime. Once that individual dies, the assets within the trust are immediately distributed to the designated beneficiaries without going through probate. The key is the clear legal transfer of ownership from the individual to the trust.

Make Gifts During Your Lifetime

Gifting property during your lifetime is one of the simplest ways to avoid probate, since property that you no longer own will not be subject to the probate process. Maryland has no gift tax, so the only thing to consider is the federal gift tax. As of 2023, individuals could gift up to $17,000 per recipient per year without incurring the gift tax. Federal regulations may change, of course, so consult with a lawyer as to the current regulations.

For Smaller Estates, Look into Simplified Probate Procedures

For smaller estates, Maryland has a simplified probate process. This, of course, is not avoiding probate, but the simpler process means less time and expense for transferring property. An estate qualifies for the simpler process if it is under $50,000 and there is no surviving spouse, or if it is under $100,000 and there is a surviving spouse.

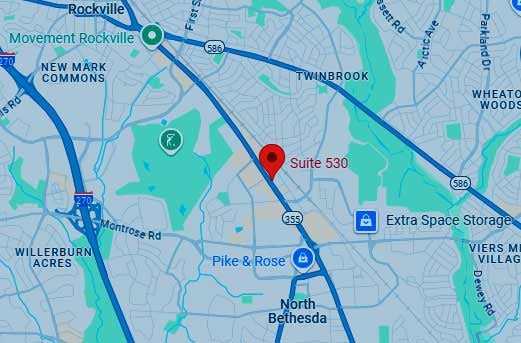

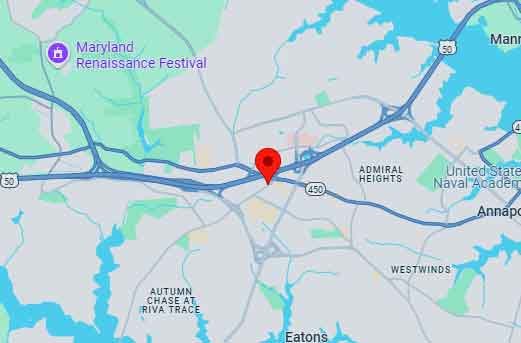

If you are looking for ways to transfer property without probate, get in touch with Elville and Associates in Columbia, MD, for legal advice and help with the process for anyone in Maryland and the D.C. area.