There are many types of trusts that can protect your estate, but choosing the right trust for your needs requires experience and extensive knowledge of the law, related tax issues, and more. Talk to a trusts and estates lawyer here in Columbia, MD to get details on all the trust options and decide what will work best with your goals.

From a Trusts and Estates Lawyer in Columbia, MD: Meeting Your Goals With Revocable and Irrevocable Trusts

A revocable trust is often the best choice if you want to keep full control of your assets and are just looking for a simple way to avoid probate and ensure that things smoothly transfer upon your death. You can make updates to this trust as your life circumstances change. These trusts are particularly useful if flexibility is one of your primary goals.

An irrevocable trust is often the best choice for high-net-worth people who really need to reduce estate taxes, as well as for business owners who need to protect their personal assets from creditors or potential lawsuits. This type of trust is also typically how generational wealth is preserved and is also best for charitable estate gifts. It’s also right for those planning for their long-term healthcare, as it removes assets from your name so that they don’t count against you and make it impossible to access Medicare benefits.

Details of Revocable Trusts

What makes a revocable trust so useful is how easy it is to revise or revoke. So long as there’s no question of mental competence, these trusts are easy to adjust. Additionally, though you have moved some of your assets into the trust, you can name yourself the trustee and then continue to manage and use those assets just as if they were part of the rest of your estate.

A revocable trust will allow your loved ones to avoid probate because everything in the trust belongs to the trust, not to you personally. Therefore, when you pass, these assets avoid probate and go straight to the beneficiaries. This means they do not become part of the public record, and there is no delay. However, what’s critical to understand is that assets in this type of trust will remain part of your taxable estate.

Details of Irrevocable Trusts

An irrevocable trust cannot easily be changed once it’s created, and that is both the source of its strength and the primary downside to this type of trust. Once you transfer the assets into this trust, they are very protected financially, and you enjoy the best tax protections, as well. However, you have transferred the assets out of your control, and if you should change your mind later, it’s almost impossible to do anything about it.

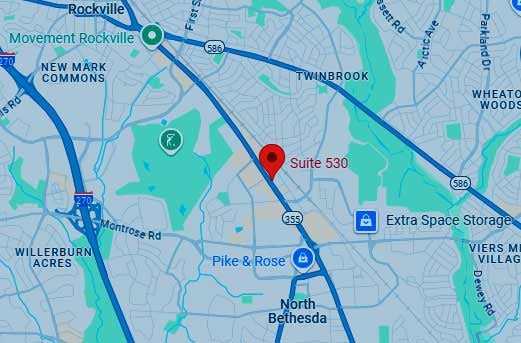

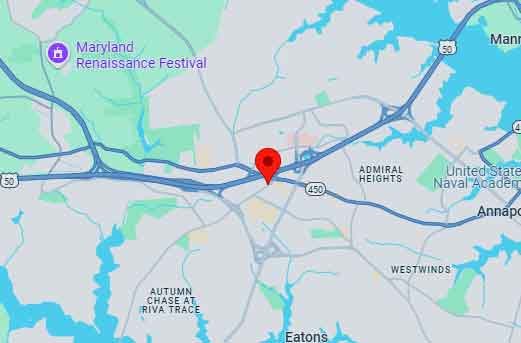

It’s important to choose wisely when setting up a trust, and we can help. Schedule a free consultation with us today at Elville and Associates in Columbia, MD at 443-339-5638, or call our Rockville office at 240-456-1657. We also serve clients by appointment only in Annapolis.