What Is Supplemental Security Income (SSI)?

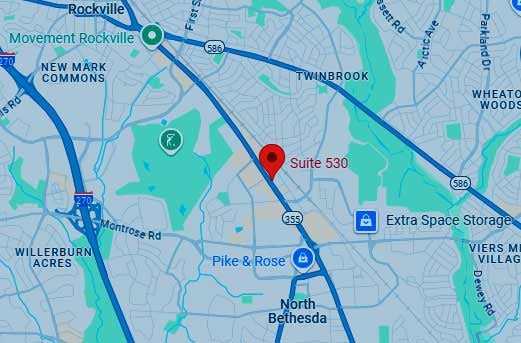

Schedule Your Free Estate Planning Consultation

Supplemental Security Income (SSI) is a federal program that helps people with disabilities and very low incomes pay for food, clothing and shelter. SSI is often confused with Social Security Disability Insurance (SSDI). One of the main differences between the two programs is that SSDI is available to people with disabilities no matter how much money they earn or have, while SSI places very strict limits on a recipient’s income and assets. However, in most states, an SSI beneficiary who receives even $1 from the program also qualifies for Medicaid health coverage, which can be far more valuable than SSI’s benefit itself.

Because SSI’s income and resource limits are so restrictive, it pays to know the basics about the program before deciding whether it is right for your family member or you.

In Order To Qualify For SSI, You Must Be Aged, Blind or “Disabled”

This first requirement is often the hardest for SSI applicants to meet, in large part because the federal government’s definition of “disabled” is so narrow. In essence, adult SSI applicants who are seeking benefits based on a disability must show that they are almost completely unable to work at any job whatsoever. The applicant must have a physical or mental impairment that makes it impossible for him to engage in any “substantial gainful activity,” and this impairment must be expected to last for longer than one year or to result in death. If an applicant is able to engage in substantial gainful activity, then he will typically not be eligible for SSI. A child applicant must have a physical or mental impairment that results in marked and severe functional limitations and can be expected to last for longer than one year or result in death.

An SSI Beneficiary Must Have Very Limited Resources

Once an SSI applicant has shown that she is disabled, she must also prove that she has less than $2,000 to her name. If the applicant can use or liquidate an asset to pay for food or shelter, the asset will probably count as a “resource” against this limit. A resource would include any funds held in the applicant’s bank accounts, retirement accounts, or in cash. If the applicant has set up a trust that does not meet specific requirements, the trust funds are also counted against the $2,000 limit. The applicant’s own home will not be considered an available resource, and her car is also exempt. The $2,000 resource limit does not disappear once a person qualifies for SSI. If an SSI beneficiary ends a month with more than $2,000 in her name, she will lose her benefits in the following month.

SSI recipients get only a modest monthly benefit, and this sum is reduced by any income they may have. In 2025, the maximum federal SSI benefit is $967 a month for an individual, although many states add a small supplement to this. In addition, SSI benefits are reduced by $1 for each dollar of unearned income a beneficiary receives (such as interest or dividends), and by $0.50 for each dollar of earned income (such as wages). SSI benefits are also reduced if an adult beneficiary lives in someone else’s home without paying rent, or if he receives free meals. Finally, the income of the people living with the beneficiary can count against the beneficiary. If the beneficiary’s combined income reduces his SSI benefit to zero, he loses SSI, along with any Medicaid benefits that may come with it.

Supplemental Needs Trusts Can Help

Although SSI’s income and asset rules are highly restrictive, several types of trusts, called “Special Needs” or “Supplemental Needs” trusts, can protect an SSI beneficiary’s assets while allowing her to maintain SSI eligibility. Relatives and friends of the SSI recipient can also set up a trust for the recipient and fund it with their own money. If properly structured, these trusts also will allow an SSI recipient to continue receiving benefits. Unfortunately, a poorly drafted special needs trust can destroy any hopes an applicant has of ever qualifying for SSI.

Why Choose Elville & Associates for SSI Help in Maryland

When it comes to SSI cases, personal attention matters. Our attorneys take the time to understand your unique circumstances and walk you through each step of the process. Here’s why Maryland residents turn to us:

- Deep understanding of SSI regulations – We stay current on Social Security laws so we can anticipate and overcome common hurdles.

- Personalized approach – Your case isn’t just another file; we work closely with you to ensure your application or appeal reflects your specific needs.

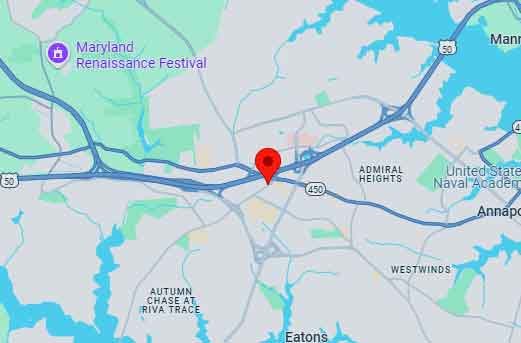

- Local knowledge – We know the Maryland SSA offices, their procedures, and the common challenges local applicants face.

- Support beyond the application – From appeals to ongoing benefit questions, we’re here as a long-term legal resource.

Eligibility for SSI in Maryland

To qualify for SSI, you must meet the following federal requirements:

- Be 65 or older, blind, or disabled.

- Have limited income and financial resources (as defined by the SSA).

- Be a U.S. citizen or certain categories of non-citizens.

- Reside in one of the 50 states, the District of Columbia, or the Northern Mariana Islands.

Our team can review your situation to determine whether you meet these requirements and help prepare the strongest possible application.

The SSI Application Process

Applying for SSI involves detailed forms, financial documentation, and sometimes medical evidence. A single error can delay or deny your benefits. Elville & Associates guides you through:

- Initial Eligibility Assessment – We review your circumstances to confirm SSI is the right path for you.

- Gathering Documentation – From medical records to financial statements, we ensure your application is complete.

- Filing the Application – We handle submission to the appropriate Maryland Social Security office.

- Appeals – If you’ve been denied, we represent you in reconsideration hearings or before an administrative law judge.

Common SSI Challenges We Help Overcome

- Denials due to incomplete or inaccurate applications

- Proving disability to SSA standards

- Navigating the appeals process

- Maintaining eligibility after approval

- Understanding the impact of work or other income on SSI benefits

Your Maryland SSI Advocates

At Elville & Associates, we believe no one should navigate the SSI system alone. Whether you’re applying for the first time or appealing a denial, our attorneys provide the legal guidance and personal attention you need.

Schedule a Free Consultation Today

If you need help with Supplemental Security Income (SSI) in Maryland, call 443-339-5638 or contact us online to schedule a free consultation. We’ll discuss your situation, explain your options, and start building a plan to secure your benefits.